Carefully review Texas title loan agreements for interest rates, repayment terms, and fees to make informed decisions when comparing Fort Worth offers. Understand collateral requirements, prepayment penalties, and lender reputation to avoid hidden costs and secure the best option based on individual needs.

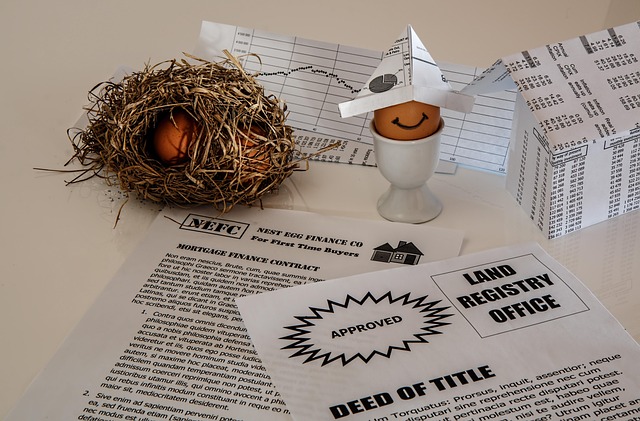

In the competitive landscape of Texas title loans, understanding your agreement is crucial. This comprehensive guide equips you with the knowledge to navigate and compare loan offers effectively. We break down the key components of Texas title loan agreements, enabling you to make informed decisions. By learning how to read between the lines, you’ll protect yourself from hidden fees and ensure the best possible terms for your financial needs. Dive into this essential guide for a Texas title loan comparison.

- Understanding Texas Title Loan Agreements

- Key Components to Compare and Evaluate

- Protecting Yourself: Reading Between the Lines

Understanding Texas Title Loan Agreements

When considering a Texas title loan, understanding the agreement is paramount. These agreements outline the terms and conditions of the loan, including interest rates, repayment schedules, and any collateral requirements. It’s crucial to read every line carefully, as hidden fees or complexities can significantly impact your financial situation. A thorough review helps in making informed decisions, especially when comparing different Fort Worth loans, ensuring you choose the option best suited for your needs and budget.

In the context of a Texas title loan comparison, borrowers should pay special attention to the loan’s terms. Some agreements may offer attractive low-interest rates but include restrictive repayment clauses or hidden costs. Others might provide flexible repayment plans with reasonable interest rates, making them ideal for debt consolidation. Whether you’re seeking a quick cash solution or looking to consolidate existing debts, knowing the details of your Texas title loan agreement is essential in navigating the market effectively and avoiding potential financial pitfalls.

Key Components to Compare and Evaluate

When comparing Texas title loans, several key components are essential to evaluate. Firstly, consider the interest rates and fees associated with each loan offer. These can vary significantly between lenders, impacting the overall cost of borrowing. Secondly, examine the loan terms, including repayment periods and any prepayment penalties. Understanding these terms is crucial for managing your finances effectively.

Additionally, look into the lender’s reputation and customer reviews to gauge their trustworthiness. Fort Worth loans, for instance, have varying conditions that may benefit specific borrowers. Some lenders also offer specialized services, such as semi-truck loans, catering to unique financial needs. Always read and understand the loan agreement before approval to avoid hidden costs or terms that could affect your decision.

Protecting Yourself: Reading Between the Lines

When considering a Texas title loan comparison, reading between the lines is crucial to protecting yourself. Loan agreements can be complex and filled with legal jargon, so it’s essential to understand every term and condition before signing. One critical aspect to focus on is the repayment schedule and associated fees. Look for details on interest rates, late payment charges, and any hidden costs that could significantly impact your financial situation.

A thorough review should also include understanding how the loan is secured. Texas title loans often require the use of a vehicle’s title as collateral. Be clear on the consequences if you’re unable to repay the loan—will the lender repossess your vehicle, or are there alternative arrangements for resolving the debt? Knowing these details can provide financial assistance and help you make an informed decision, ensuring a smoother process throughout the loan approval journey.

When comparing Texas title loans, understanding and reading your loan agreement thoroughly is a crucial step in protecting yourself. By familiarizing yourself with the key components outlined in this article, from interest rates to repayment terms, you can make an informed decision. Always read between the lines to avoid hidden fees or restrictive conditions that may negatively impact your financial well-being. A prudent approach when considering a Texas title loan involves comparing multiple offers and choosing a lender that aligns with your best interests.